Ahhhhh

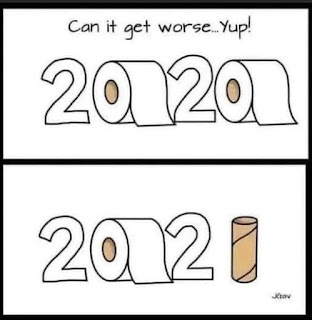

Welcome 2021!

Just the fact that you aren’t called 2020 makes you already better!

All jokes aside, New Year’s always kind of brings a sense of hope to me. Yes, there are unknowns like there are every day of the week, but there’s the promise that we made it through another year, even a crappy year like 2020! And while you would probably think that I wanna focus on the year ahead, what I want to bring up first in this first post of 2021 is Christmas or Hanukkah or whatever gift-giving holiday you may celebrate at the end of the year.

Right now many of you are receiving your credit card statements from the generous holiday you just finished celebrating… You may or may not have enough money to pay off the bills or you may have been scraping the bottom of the barrel to pay your rent today. If either of these are you, now is the best time to address this! Let’s nip this in the bud for good! I’m not talking about 2020s bills though, yes, you should be focusing on those and getting those paid off, but what I’m really talking about is 12 months from now do you wanna see yourself in the same situation? What can you do today to give yourself the security that you can be generous without the financial burden of debt next holiday season?

This is where slight discomfort every paycheck gives you incredible peace of mind and lots of fun spending power come next holiday season… look at how much money you spent this holiday season factoring in Black Friday splurges, gifts for your children and family, end of year donations, etc. When you get the total of these once a year expenditures, divide by the number of paychecks you have in a year. That is the amount that you should be putting in a separate savings account through banking automation with every paycheck.

For me, I get paid every two weeks and my work allows me to deposit my paycheck into multiple accounts at my credit union, so I automatically have my Christmas money put into my Christmas savings account every two weeks. Because I get paid every two weeks, I divide my Christmas spending by 26 to figure out how much money I need to be saving from every paycheck.

The key is to set this up now! Complete banking automation either through your work or by setting up automatic transfers at your bank or credit union. If you don’t know how to set this up on your bank’s app or website, don’t hesitate to ask a banker for help. This is an invaluable lesson that’s worth a bit of your time to learn! This is one of those “set it and forget it” life hacks. Come time to start shopping next fall, all that money will be sitting there waiting for you! Easy Peasy, guilt-free spending!!

Having the money there- ready to be spent- makes shopping so much more enjoyable! Knowing that you’re not going into debt and that this money is there for those Black Friday splurges and those special loved ones will have a gift from you because you planned ahead and made automated savings a priority as you rang in the New Year! Happy saving and have an amazing start to 2021!! 💛